The Traditional Business of Football: A Fragile Foundation

For decades, football clubs mostly relied on three major sources of income: ticket sales on match days, broadcasting rights, and sponsorship deals. While these were enough to grow football into a global phenomenon, they were not always reliable. Clubs were extremely vulnerable to changes in form, poor management, economic shocks, and more recently, global crises like COVID-19.

For example, match-day revenue could make up over 25% of a club’s total income, and when stadiums were empty during the pandemic, clubs immediately found themselves in financial chaos. At the same time, the cost of running a top-tier club kept rising. Player salaries, transfer fees, agent commissions, and infrastructure investments have all gone up dramatically over the last two decades.

This imbalance with growing costs versus fragile income left even big clubs like FC Barcelona with over €1 billion in debt, pushing the football world to rethink how it finances itself.

Why Private Equity Became Interested in Football

Traditionally, private equity funds invested in high-growth sectors like technology, healthcare, or energy, industries where growth and profits were more predictable and scalable. So why football?

The answer lies in the commercial transformation of the sport. Football is no longer just a game today, it is a global media product with billions of loyal followers. Between TV rights, streaming, merchandise, and data-driven fan engagement, the business of football has become far more attractive to financial investors.

Today, global football clubs are seen as under-optimized assets. They have large fan bases but often poorly run business operations. For PE funds, this is a clear opportunity: inject capital, professionalize management, and scale up global revenues (much like a struggling startup being turned around).

And most importantly, the pandemic opened the door. When clubs were cash-starved, PE funds entered not only as lenders or emergency partners, but also as strategic investors with long-term influence.

The Big Shift: PE Becomes a Game Changer (2020–2024)

Let’s break down the key private equity movements that changed football forever, not just in theory, but in hard numbers and real deals.

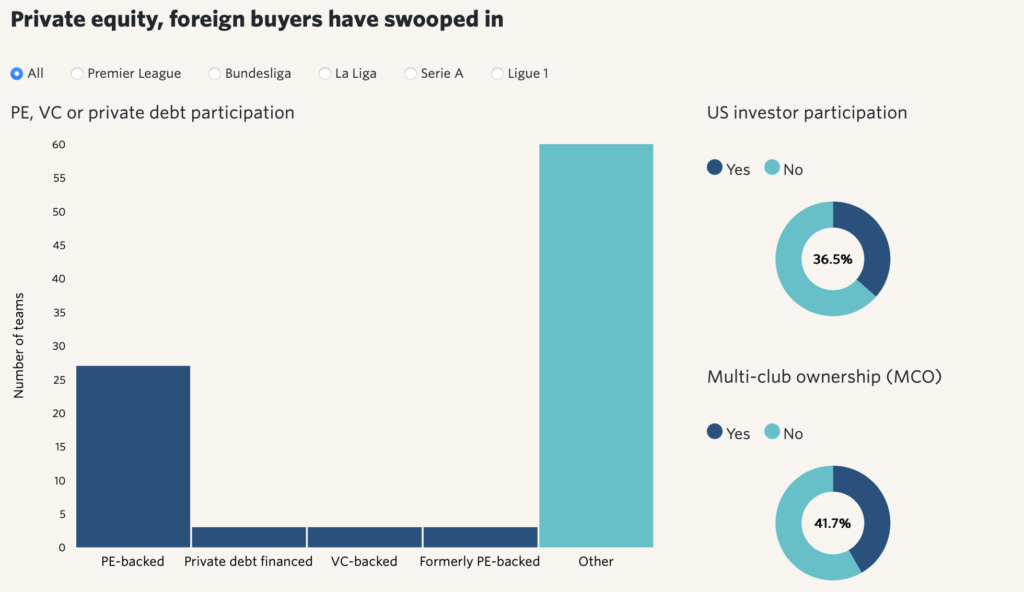

Source: PitchBook

CVC Capital Partners and LaLiga (2021) – In one of the most important deals in modern football finance, CVC Capital Partners invested €2.1 billion into LaLiga, Spain’s top football league. In return, they secured an 8.2% share in a new media company that manages broadcasting rights for the next 50 years.

This deal helped LaLiga clubs:

- Repay debts

- Improve training grounds and stadiums

- Invest in youth academies and digital transformation

CVC pushed clubs to become more modern, transparent, and sustainable. Small clubs like Cádiz and Elche received tens of millions in immediate support, funds that would’ve otherwise taken decades to earn.

RedBird Capital and AC Milan (2022) – In 2022, RedBird Capital bought AC Milan for €1.2 billion. They weren’t just buying a football team, they were buying a global brand with history, massive commercial potential, and an opportunity for growth.

Their plan? Focus on three pillars:

- New stadium to boost match-day revenue (currently, Milan rents San Siro, limiting revenue upside).

- Technology and analytics to improve on-pitch performance.

- Expand globally, especially in the U.S. and Asia, where Milan’s brand is strong but underexploited.

RedBird had already tested this strategy with Toulouse FC in France, which they took from financial collapse to promotion into Ligue 1.

Silver Lake and City Football Group (2019–2024) – Silver Lake, a massive tech-focused PE firm, invested first in City Football Group (CFG) — which owns Manchester City, New York City FC, Melbourne City FC, and others — in 2019, buying over 10% of the group.

By 2024, Silver Lake increased its stake, valuing CFG at over $5 billion, making it one of the most valuable sports groups globally.

This deal shows a different strategy: instead of buying a single club, CFG and Silver Lake push a multi-club ownership (MCO) model. This allows them to:

- Centralize scouting, analytics, and player development

- Share commercial deals across countries

- Move players between clubs to balance costs and talent

Ares Management, Atlético Madrid and Inter Milan (2021) – Ares Management invested €181 million in Atlético Madrid and lent +€200 million to Inter Miami.

These were rescue deals during COVID, helping clubs pay wages and refinance debt. But more importantly, Ares started exploring MCO models like Silver Lake, aiming to create networks of clubs with shared data, sponsorships, and operational strategies.

What PE Actually Brings to Football: More Than Just Money

When private equity enters football, it doesn’t just bring cash. It changes how clubs are run from top to bottom.

Governance and Discipline – PE firms impose strong corporate governance: budgets, performance targets, and professional boards. Many football clubs previously acted like passion projects, now they behave like businesses with shareholders.

Technology and Data – Firms like RedBird and Silver Lake apply advanced analytics to scouting, player fitness, ticket pricing, and even fan behavior.

Global Expansion – PE investors want growth, and that means international markets. This is why we see more friendly matches in the U.S., more merchandise collaborations in Asia, and streaming partnerships globally. Clubs like Manchester City and Milan are now as much brands as they are sports teams.

Risks, Tensions, and What Fans Are Worried About

Still, not everyone is excited. Many fans worry that PE ownership might:

- Destroy club identity by turning teams into businesses first

- Push for short-term profits instead of long-term sporting success

- Lead to decisions that ignore local traditions or fan culture

There’s also the problem of Financial Fair Play (FFP). While PE brings capital, UEFA rules still limit how much can be spent. Navigating this balance is hard, as some clubs under PE ownership have already been investigated for breaching FFP.

Finally, economic volatility (inflation, rising interest rates, or political uncertainty), can make returns less predictable. If a fund doesn’t see profits fast enough, it might sell or push risky strategies.

The Road Ahead: What’s Next for PE and Football

Private equity in football is still evolving. Future trends could include:

- More multi-club models, with data and strategy shared across continents.

- Decentralized finance (DeFi) and fan tokens being integrated into club business models.

- Greater focus on sustainable infrastructure, like eco-friendly stadiums and youth academies.

- Exit strategies, as early investors like CVC and Ares eventually look to sell for a return.

But long-term success depends on one key thing: alignment. If PE funds can balance business logic with football’s culture, if they can improve performance without ruining tradition, then this could be the start of a golden era for both football and finance.

Conclusion

From being a chaotic, passion-driven industry to becoming a professional, global business, football is undergoing a huge transformation, and private equity is at the heart of this revolution. The shift began with emergency capital during COVID-19, but it is now clear that PE sees football as a serious investment, with global reach, loyal users (fans), scalable media products, and untapped commercial value.

Whether you’re a football fan or a finance geek, the game has changed forever. The question now is not whether private equity belongs in football, but how far it will go, and what the sport will look like when it gets there.