How Big Investments and Cost Challenges Are Shaping the Game

Women’s football is making headlines not just for the action on the pitch but also for the huge money moves behind the scenes. On one hand, the sport is attracting record investments, innovative sponsorship deals, and strong broadcast agreements. On the other, many top clubs are still losing money, with revenues covering less than 60% of their costs. Let’s dive into the numbers and examples to see both sides of this financial story.

A Market Bursting with Opportunity

Recent reports show that elite women’s sports are set to generate around US$1.28 billion in revenue in 2024. Football alone is expected to bring in about US$555 million. Big clubs are riding this wave of growth:

- Arsenal Women have seen a 138% year-on-year revenue jump.

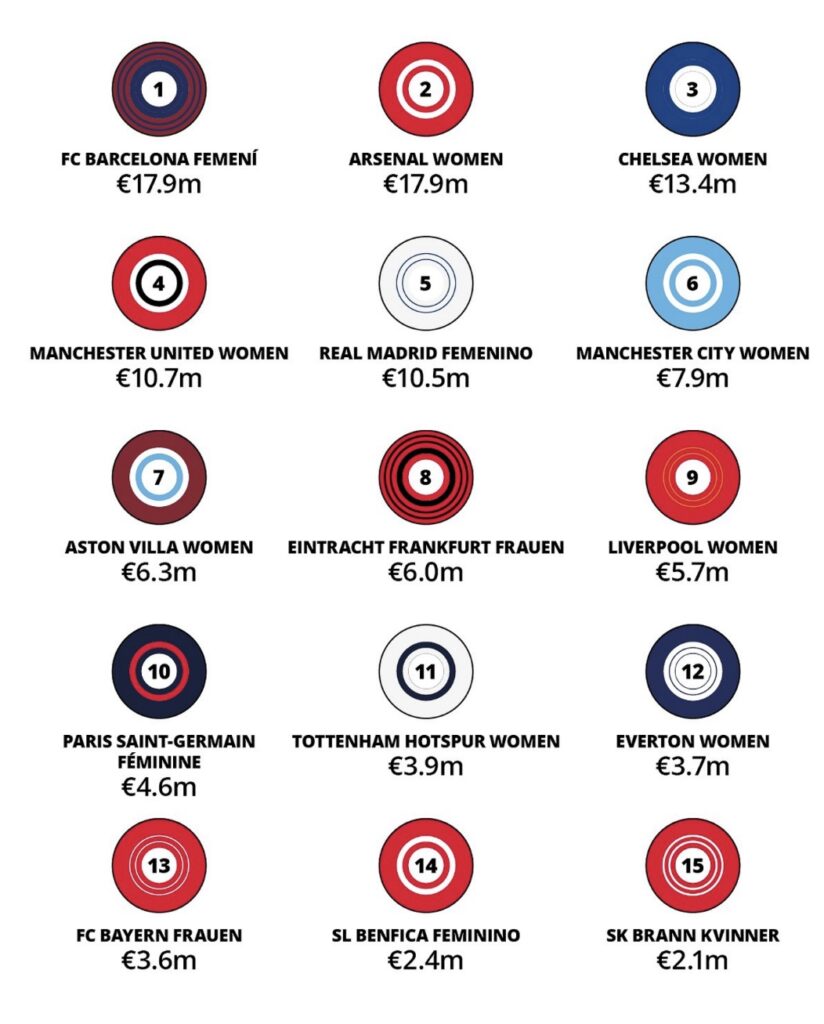

- FC Barcelona Femení reported a 26% revenue increase, with figures around €17.9 million.

- The top 15 women’s clubs in the 2023/24 season together made €116.6 million, marking a 35% growth from the previous season.

Money Talks – Sponsorships, Broadcast Deals, and Digital Innovations

Money isn’t only coming from ticket sales; the real cash flow is driven by sponsorship and broadcast deals, with Deloitte’s Football Money League 2025 showing that commercial deals make up about 66% of these revenues. Major brands are diving in:

Sponsorship Deals: Rexona’s “Breaking Limits” program spans 13 markets, while Dove’s partnership with NJ/NY Gotham FC includes what is reportedly the highest back-of-jersey deal in the NWSL history, valued at over $500,000 per year. Additionally, Nike, Coca-Cola, EA SPORTS, and Adidas are among the top sponsors fueling the sport’s growth.

Broadcast Revenue: The Women’s Super League (WSL) recently secured a broadcast deal with Sky Sports and BBC, valued at €8.7 million annually—set to rise to €15.2 million with the new agreement starting from the 2025/26 season. Liga F’s broadcast deal with DAZN is worth around €7 million. Moreover, digital platforms like YouTube have proven vital; the WSL’s YouTube channel garnered over 1.5 million live views in just the first three game-weeks of the 2024/25 season.

Digital Engagement: Around 37% of women’s football fans actively follow the sport on social media, a statistic that underscores the effectiveness of digital-first strategies. For example, Borussia Dortmund’s women’s team has built an Instagram following of over 40,000, demonstrating the power of online engagement.

The Startup Reality: High Costs and Financial Losses

Even with all these exciting numbers, many top clubs are still struggling to break even. In 2024, elite women’s clubs in major markets had an average cost of €2.1 million, while their revenue was only about €1.3 million. This means clubs are covering less than 60% of their expenses. FIFA reported that 67% of top-tier clubs (tier‑1) lost money in 2024. Only 15% made a profit, while 18% managed to break even.

The financial challenges are even starker in lower tiers:

- Tier 2 clubs average around US$88,000 (about €81,000) in revenue but spend roughly US$316,000 (around €292,000).

- Tier 3 clubs generate only about US$20,000 (around €18,900) compared to costs of around US$48,000 (roughly €44,400).

Source: FIFA (2playbook)

In these lower tiers, sponsorships still drive most revenue—57% in tier 2 and 47% in tier 3—but TV rights are almost negligible, contributing only 2% to overall income. For tier‑1 clubs, matchday revenue now makes up 31% of total income, boosted by larger stadiums and more frequent matches.

Additionally, a large part of the income is swallowed by player salaries:

- In tier‑1 clubs, 48% of revenue goes to salaries.

- In tier‑2 and tier‑3 clubs, this percentage rises to 139% and 95%, respectively, meaning these clubs sometimes spend more on wages than they earn overall.

Even external funding has its limits. In 2024, elite clubs received on average US$492,000 (around €455,000) from public and private support. This funding mainly came from local governments (about US$158,000) and club owners (around US$115,000). Yet, only about 14% of women’s clubs have received external financing, which shows that many still depend on their own cash flow while trying to grow.

Balancing the Scales: Investment and Future Prospects

Despite the challenges, the overall picture is one of rapid growth and huge potential. UEFA projects that the commercial value of women’s football in Europe will hit €686 million by 2033, with team sponsorships reaching nearly €300 million. New investments in purpose-built stadiums, digital media, and better training facilities are on the horizon.

Some clubs are already taking bold steps:

- Chelsea Women have restructured to operate alongside their men’s team, aiming to attract independent investment.

- Big-name clubs like FC Barcelona Femení and Arsenal Women continue to invest heavily in their teams, hoping to build long-term financial stability.

Major international tournaments also promise to bring more money into the game. With events like the FIFA Women’s World Cup and Women’s EUROs on the horizon, along with UEFA’s commitment of €1 billion over the next six years to boost the women’s game, the future looks promising. But for now, many clubs must balance rapid growth with high costs, much like a startup burning cash to achieve scale.

Conclusion

Of course, the road ahead isn’t completely smooth. There are still hurdles, like pay disparities and the risky dependency some clubs have on the fortunes of their men’s teams. For example, when a men’s team hits financial trouble, it can drag down the women’s team with it. However, this challenge is also driving innovation. Clubs are beginning to explore independent investment models, such as Chelsea Women repositioning itself to operate on its own, paving the way for more sustainable growth.

Women’s football stands at an exciting yet challenging crossroads. On one side, record-breaking revenues, major sponsorship deals, and promising broadcast agreements are driving the sport toward a multi-billion-dollar future. On the other, many clubs are still losing money, with revenues that cover less than 60% of their expenses and heavy reliance on external funding that remains scarce.

Every statistic—from Arsenal Women’s 138% revenue jump to the average €2.1 million in expenses for elite clubs, tells the story of a sport in rapid transition. The financial and economic landscape of women’s football is complex, full of both opportunity and risk. As investors, sponsors, and fans back the game, the challenge will be to turn these promising figures into long-term stability.

The journey of women’s football is not just about the passion for the game; it’s also a bold experiment in sports finance. With every deal, every match, and every kick on the pitch, the sport is writing a new chapter in its financial story—one that promises both incredible rewards and significant challenges.